College Savings: The Statistics You Need to Know

As higher education gets more expensive each year, working parents feel the urge to plan ahead of time. They need financial wellness to help them pave the way for their children’s education.

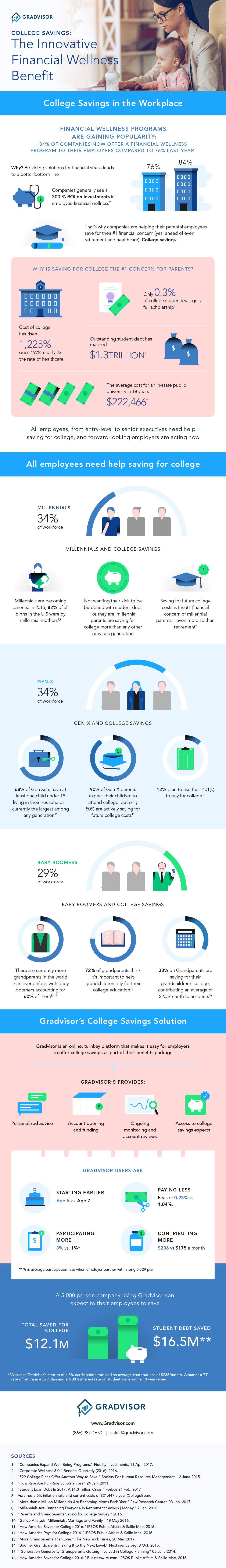

That is why more companies nowadays provide college savings programs for their parental employees. It is reported that college savings are the number one financial concern of working parents, overtaking retirement and healthcare.

The Reasons College Savings are Important for Parents

There are at least four reasons why saving for college has become the primary financial concern for working parents, as follows:

- Cost of College has risen 1,225% since 1978

- Only 0.3% of college students will get a full scholarship

- Student debt has reached an outstanding number of $1,3 trillion

- The average cost for an in-state public university in 18 years is $222,466

Employees Who Need Help Saving for College

Working parents nowadays come for the millennials and Gen-X. However, baby boomers who are now becoming grandparents also want to support their grandchildren’s education.

The Millennials, 34% of the Workforce

Parents who were born from 1981 to 1996 are categorized as millennials. In 2015, 82% of all births were by millennial mothers in the United States.

They need to do college savings because they don’t want their kids to be burdened with student debt.

Gen-X 34% of the Workforce

Those parents born from 1965 to 1980 are now 42 – 57 years old and categorized as Gen-X. As much as 90% of them have expectations for their children to attend college. Yet, only 50% are actively saving for future college costs.

Baby Boomers 29% of the Workforce

The Baby Boomers generation was born between 1946 to 1964 and is now around 58 years old. At that age, most of them have already become grandparents.

Those who are still actively working said they want to help their grandchild achieve a college education. As much as 33% of grandparents save for their grandchildren’s college.

Gradvisor’s College Saving Solution

Gradvisor is an online and turnkey platform that offers college savings to employers as part of their benefits package. It provides four leading offers, which include:

- Personalized advice

- Account opening and funding

- Ongoing monitoring and account reviews

- Access to college savings experts

In addition to that, Gradvisor also offers several benefits for its users, that includes:

- Paying less: Fees of 0,23%

- Contributing more: $236 a month

- Starting earlier: Age 5

- Participating more

Using Gradvisor as a financial wellness program allows employees to save $12,1 million, with the assumption of contributing $236 per month.

Conclusion

The data show that parents nowadays are aware of their children’s education. Most of them realize that higher education fees constantly rise each year, so they need a solid plan to overcome that.

College savings provided by the company are expected to lessen the burden on working parents. Setting aside a certain amount of their income can help them provide a brighter future for their children.