Commonly Confused Credit Terms

According to statistica.com, 65% of people in the United States own credit cards as of 2017. This means that over half of the population choose credit cards to pay bills, shop, and do other transactions.

However, America was not on top of the list in terms of credit card ownership as it drifted away by five ranks from Canada which came out to be the highest country with 82,6% of credit card ownership. Take a look at a research done by Raynor de Best Credit card penetration in 144 countries worldwide 2017.

Lack of Credit Card Knowledge

What’s more shocking is that those who chose not to use credit cards in America came from millennials. Based on the study conducted by LendEDU, millennials were said to lack credit card knowledge.

It is reported that most of them didn’t know how credit cards work. It is somehow understandable because the way it works is different from cash payment and debit cards.

Besides, it has some terms that might be confusing for some people, especially those who were born in the last decades of the 20th century.

Credit terms do not only apply when you shop for a credit card. You can also find credit terms when looking for a loan, a line of credit, or some other credit products.

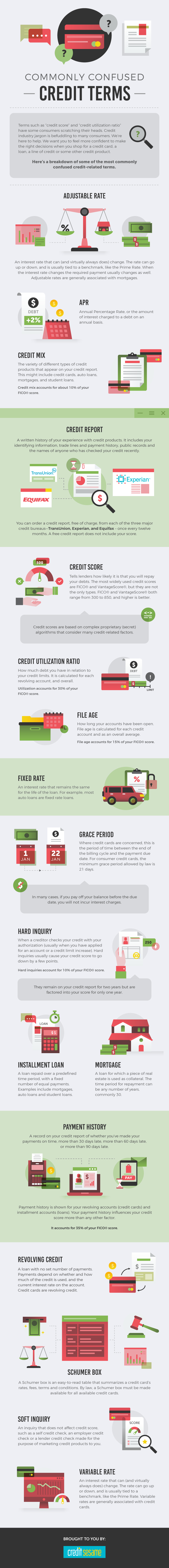

If you are one of those people, we provide a list of credit terms that commonly confuse and intimidate people. Take a look at the infographic to know the meaning.

| Adjustable Rate | File Age | Payment History |

| APR | Fixed Rate | Revolving Credit |

| Credit Mix | Grace Period | Schumer Box |

| Credit Report | Hard Inquiry | Soft Inquiry |

| Credit Score | Installment Loan | Variable Rate |

| Credit Utilization Ratio | Mortgage |

What To Do Before Getting a Credit Card

Understanding the common credit terms is a wise move before shopping for credit cards, getting a loan, or doing any other credit products.

Make sure you study those terms and be confident whenever you are ready to get involved in the credit world. Therefore, you can decide what product and installment are suitable and work best for you.

Check out this infographic by Milkwhale, below!