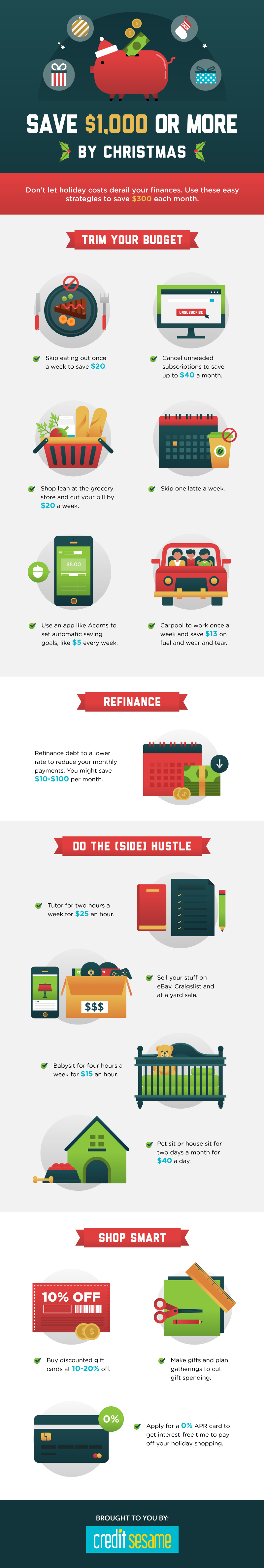

Save $1000 or More by Christmas

There are many ways to secure $1000 or more by Christmas. The key to saving money is consistency. Once you commit to it, you won’t derail your finances during the holiday.

You can start by living smart and spending wisely. These several tips on saving money can help you save $300 each month.

Here are easy strategies that you can implement to save $1000 or more by Christmas.

Trim Your Budget

Trimming a budget might be challenging for some people as it is part of their lifestyle. However, these several strategies won’t interfere too much with your way of living.

#1. Skip Eating Out

Eating at a café or restaurant can be one of your main expenses if you do it daily. If eating out is part of your lifestyle, try simple attempts like skipping it once a week to save $20 or even more. As a solution, you can cook simple dishes at home.

#2. Cancel Subscriptions You Don’t Need

Subscriptions for entertainment can cost more than you think. Figure out how many subscriptions you are in. Cancel those that you rarely use or watch.

Canceling unused subscriptions help you save up to 40% of your budget in a month.

#3. Shop at a Grocery Store

If you live alone, it is cheaper to grocery shop rather than eat out. There is a variety of affordable food that is just as hearty and filling as restaurant meals.

In a week, you might go grocery shopping one to three times, and it can cut your bill by $80 a month.

#4. Skip One Latte a Week

One cup of latte costs around $2.95 to $5.25. If you substitute it with mineral water, it will cut your spending significantly.

If you’re a caffeine person, you can go with the cheaper options like Americano or instant coffee.

#5. Use App to Set Saving Goals

Sometimes people have a hard time managing their savings. If you are, too, try using a saving app that you can track using a smartphone.

One of the saving app recommendations is Acorns. It helps you set automatic saving goals, around $5 every week.

Refinance

To reduce your monthly payments, you can refinance your debt to a lower rate. The disadvantage of this is your debt may take longer to pay off.

However, you can save $10-$100 a month if you lower your debt rate.

Side Hustles

If you want to save more money for a particular time, you can do a side hustle. Here are some options for a hustle job that you can do.

- Tutoring: $25 per hour

- Baby Sit: $15 per hour

- Pet Sit/ House Sit: $40 per day

- Selling Stuff

Shop Smart

Last but not least, one final thing that you can do to build up your savings is to shop smart. Try these three tips on how to shop smart.

- Buy discounted gift cards at 10-20% off.

- Make gifts and plan gatherings to cut gift spending

- Apply for a 0% APR card

Last Thought

Attempting to make savings, especially during holidays, can be very challenging. Don’t let your holiday costs derail your finances, and always plan ahead of time.

Setting goals and being consistent with them is the primary key to savings. One last thing, never be ashamed of living modestly.

If you want to know more about money management, take a closer look at Millennials Money Management: The More You Save, The More You’re Safe.